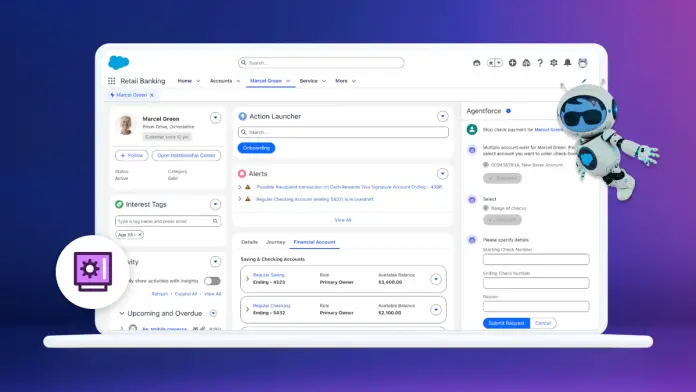

In the rapidly evolving landscape of financial services, businesses face mounting pressure to enhance efficiency and customer satisfaction amid an impending talent crisis. A recent announcement from Salesforce presents a potential solution for small business owners grappling with these challenges—Agentforce for Financial Services. This suite of AI-driven tools aims to automate routine tasks, reduce administrative burdens, and enhance client relationships, all without the need for coding expertise.

At the heart of Agentforce are pre-built, role-specific AI agent templates designed to tackle a variety of tasks in financial firms. By streamlining front-office processes—like meeting preparation and follow-ups—these tools empower financial advisors and bankers to maximize their productivity. “AI shouldn’t replace the human connection, it should scale it,” said Eran Agrios, SVP and GM of Financial Services at Salesforce. His comments highlight a growing sentiment in the industry that technology should enhance—not replace—the personal touch that defines client relationships.

The benefits for small business owners are significant. With agents tailored for both financial advisors and banking service representatives, firms can automate the gathering of client insights and preparation of meeting agendas. This allows financial professionals to focus on building deeper client relationships rather than getting bogged down in administrative tasks. Additionally, the Digital Loan Officer Agent facilitates 24/7 support for borrowers, streamlining the loan discovery process, thus improving conversion rates.

Moreover, the Banking and Insurance Service Agents automate routine requests—like reversing fees or canceling credit cards—freeing up human resources to address more complex issues. This shift not only reduces wait times but also enhances the overall customer experience, a crucial factor as client expectations continue to rise. According to Salesforce’s Connected Financial Services 2025 report, only 21% of consumers feel fully satisfied with the level of personalization from their financial services providers, indicating a pressing need for improvement.

Integrated compliance features within Agentforce further bolster its appeal. The platform operates with embedded compliance controls, ensuring that all digital actions align with industry regulations. This aspect can be especially reassuring for small business owners who often struggle to keep pace with compliance requirements. By automating compliance checks and maintaining an audit trail for actions taken, businesses can reduce the risks associated with manual errors and maintain regulatory standards more effectively.

However, while the promise of automation is appealing, some potential challenges warrant consideration. The initial implementation of AI tools often requires time and resources, which may strain smaller enterprises. Businesses must also ensure their staff are adequately trained to work alongside these technologies, fostering a collaborative environment between human and digital agents. Additionally, the success of such systems hinges on the quality and security of the data being fed into them. Any gaps in data integrity can compromise the effectiveness of the AI and potentially harm customer relationships.

For small business owners, embracing innovations like Agentforce could provide the competitive edge necessary to weather the storm of the current talent crisis. With 50% of the insurance workforce expected to retire in the next 15 years and a projected shortfall of 100,000 financial advisors by 2034, the demand for scalable solutions has never been more urgent.

Various companies have already started seeing the advantages of integrating Agentforce into their operations. For instance, CaixaBank, the leading bank in Spain, anticipates utilizing these tools to personalize banking services while enhancing employee experiences. Similarly, organizations like Cumberland Mutual and Nexo have recognized increased productivity and efficiency through preliminary deployments of Agentforce.

As small business owners weigh the value of adopting such technologies, it’s essential to consider the evolving landscape of customer expectations and the urgency for personalized interaction. Using solutions like Agentforce could not only alleviate personnel shortages but also lead to a more responsive, highly personalized client experience.

For further details about this innovative offering, you can visit the original announcement from Salesforce here. Small businesses ready to capitalize on these advancements may find themselves better equipped to meet the future demands of their clientele.

Image Via Salesforce