Key Takeaways

- Definition of Skimmers: Credit card skimmers are covert devices that capture card information during transactions, often blending in with legitimate card readers.

- Types of Skimmers: Common skimmer types include overlay skimmers, internal skimmers, keypad overlays, Bluetooth skimmers, and Wi-Fi skimmers, each posing unique risks.

- Detection Methods: Key signs of skimmers include misaligned or tampered card readers, unusual keypad textures, and broken seals at gas pumps. Regular inspections and using detection tools can help identify threats.

- Preventive Measures for Cardholders: Consumers should opt for secure payment methods, inspect card readers for tampering, and protect their PINs while entering them.

- Business Recommendations: Small businesses should educate customers about skimming risks, conduct routine inspections of payment devices, and upgrade to chip-enabled and contactless payment technology.

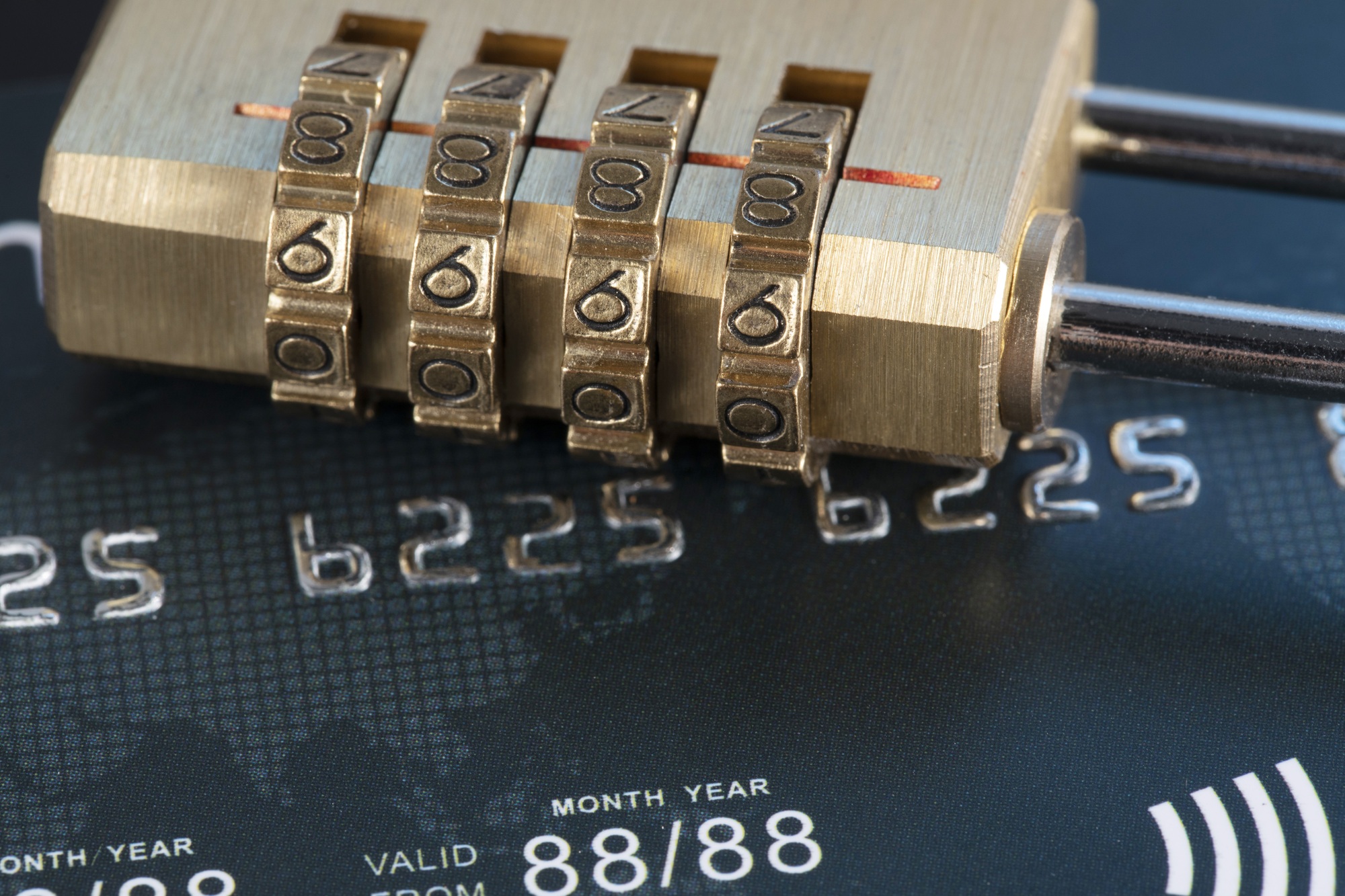

Every time you swipe your card, there’s a hidden danger lurking at gas stations, ATMs, and retail stores. Credit card skimmers have become a prevalent threat, silently stealing your financial information without you even knowing it. These small devices can be easily attached to legitimate card readers, making them hard to spot for the average consumer.

As technology evolves, so do the tactics used by criminals. Understanding how skimmers operate and recognizing their telltale signs is crucial for protecting your personal and financial data. In this article, you’ll discover what credit card skimmers are, how they work, and the steps you can take to safeguard your information. Stay informed and keep your finances secure.

Understanding Credit Card Skimmers

Credit card skimmers pose a significant risk to small businesses and consumers alike. Knowing what they are and how they operate can help you safeguard your financial information.

What Are Credit Card Skimmers?

Credit card skimmers are covert devices designed to capture card information during transactions. These devices can be attached to legitimate card readers found at gas stations, ATMs, or retail stores. Typically small and discreet, skimmers can blend in with payment equipment, making them difficult to detect. By understanding what skimmers look like, you can better protect your business and customers from fraud.

How Do Credit Card Skimmers Work?

Credit card skimmers operate by collecting data directly from the magnetic stripe of a card. When a card is swiped, the skimmer records the card number, expiration date, and other sensitive information. Some advanced skimmers also include miniature cameras or Bluetooth technology to transmit the stolen data in real-time. Awareness of these methods allows you to verify the integrity of your payment systems and keep your small business secure from theft.

Types of Credit Card Skimmers

Understanding the types of credit card skimmers helps you safeguard your small business and customers’ financial information. Here’s a breakdown of common skimmer types that pose threats.

Physical Skimmers

- Overlay Skimmers: These devices attach over existing card readers at locations like ATMs or gas pumps. Their design mimics the original equipment, making detection difficult for you and your customers. Regularly inspect card readers to identify any anomalies.

- Internal Skimmers: Installed within the mechanisms of card readers, internal skimmers present heightened risks due to their concealed nature. You may encounter these hidden inside ATMs or gas pumps. Consider having technicians check machines periodically to eliminate potential internal threats.

- Keypad Overlays: These devices sit over the keypad of an ATM or card reader, capturing customers’ PINs. They often feel different from genuine keypads—soft or raised in texture. Train your staff to recognize irregularities in keypads and encourage customers to monitor for unusual features.

Wireless Skimmers

- Bluetooth Skimmers: These advanced skimmers use Bluetooth to transmit stolen credit card data wirelessly. They can be small, compact, and difficult to spot. You might increase security by regularly scanning for any unauthorized Bluetooth connections near your payment devices.

- Wi-Fi Skimmers: Connected to nearby Wi-Fi networks, Wi-Fi skimmers collect data without physical contact. This type can be particularly insidious in public spaces. Install network security measures and educate employees about online security protocols to help protect against these skimmers.

By recognizing these types of credit card skimmers and implementing preventive measures, your small business can enhance security and maintain customer trust.

Detecting Credit Card Skimmers

Detecting credit card skimmers is crucial for protecting your business and customers. Skimmers can compromise sensitive financial data and erode customer trust. Recognizing the signs and using specific tools ensures a proactive approach to security.

Signs of a Credit Card Skimmer

- Check card reader integrity. Inspect if the card reader looks intact and properly aligned. Any bulging, raised, or misaligned parts suggest the presence of a skimmer.

- Look for tampering marks. Check for scratches, tape, or glue around the card slot. Such indications point to recent tampering.

- Inspect the keypad. Assess it for signs of tampering. A soft, spongy, or raised feel compared to a genuine keypad can signify an overlay skimmer.

- Compare colors and styles. Notice any mismatched colors or styles in the card reader and keypad areas, which may signal alterations.

- Examine gas pump seals. At gas stations, verify the security seal. A broken seal or a “void” label raises red flags about potential skimmers.

Tools for Identifying Skimmers

- Use a smartphone camera. Take close-up photos of card readers and keypads to detect subtle differences or irregularities.

- Utilize skimmer detection apps. Some mobile apps help identify signs of skimming devices by analyzing card reader functionality and form.

- Incorporate RFID scanners. These devices can detect unauthorized RFID signals, focusing on wireless skimmers that may be present.

- Conduct regular inspections. Schedule frequent checks of card readers and keypads to ensure ongoing security and quickly spot any signs of tampering.

Employing these detection strategies enhances your small business’s ability to safeguard customer data, thereby maintaining trust and loyalty.

Preventing Credit Card Skimming

To prevent credit card skimming, adopt proactive measures that safeguard your financial information during transactions.

Best Practices for Cardholders

- Use secure payment methods. Opt for contactless payments or digital wallets like Apple Pay and Google Pay. These options utilize secure tokenization and encryption technologies to protect sensitive data.

- Inspect card readers. Check for signs of tampering before using a card reader. Look for loose, misaligned parts, different colors, or unusual protrusions on the device.

- Protect your PIN. Cover the keypad with your hand while entering your PIN to shield it from hidden cameras that may capture your information.

Recommendations for Businesses

- Educate customers. Inform your clientele about skimming risks and encourage them to inspect card readers for tampering. Display clear signage by card readers promoting awareness.

- Conduct regular inspections. Routinely examine card readers and payment processes in your small business. Look for signs of tampering such as broken seals or any unusual installations.

- Upgrade payment technology. Use chip-enabled card readers and integrate advanced security features within your payment systems. Implementing contactless payment options enhances security and builds trust with your customers.

Conclusion

Staying vigilant against credit card skimmers is crucial in today’s digital landscape. By understanding how these devices operate and recognizing their signs, you can significantly reduce your risk of falling victim to fraud.

Adopting proactive measures like using secure payment methods and regularly inspecting card readers can help protect your financial information. Whether you’re a cardholder or a business owner, prioritizing security not only safeguards your data but also fosters trust and loyalty among customers.

Empower yourself with knowledge and take the necessary steps to stay one step ahead of potential threats.

Frequently Asked Questions

What are credit card skimmers?

Credit card skimmers are covert devices attached to card readers at places like ATMs and gas stations. They capture your card information during transactions, often without your knowledge, posing a serious threat to your financial data.

How do credit card skimmers work?

Skimmers work by collecting data from the magnetic stripe of your credit card. Some advanced models can also capture your PIN using keypad overlays or transmit stolen data via Bluetooth or Wi-Fi in real-time.

What types of credit card skimmers exist?

There are several types of skimmers: physical skimmers (like overlay skimmers), internal skimmers hidden in machines, keypad overlays, and wireless skimmers that transmit stolen information without physical contact.

How can I detect a credit card skimmer?

Look for signs of tampering on card readers, such as unusual textures on keypads, mismatched colors, or broken seals. You can also use smartphone cameras or skimmer detection apps for close inspections.

What should I do to prevent credit card skimming?

Use secure payment methods like contactless payments, inspect card readers before use, and cover your PIN while entering it. Businesses should educate customers and conduct regular inspections of their payment systems.

Why is it important to recognize credit card skimmers?

Recognizing credit card skimmers helps protect your personal and financial information. The more aware you are of their signs and operation, the better you can safeguard yourself against fraud and maintain trust in payment systems.

Image Via Envato