Understanding EINs

What is an EIN?

So, you’re running a business, huh? Well, say hello to the EIN, or Employer Identification Number. This is your business’s unique nine-digit code, given to you by the IRS. Think of it as the Social Security number, but for all your business escapades. If you’ve got employees or need to deal with taxes, you’re gonna need one of these bad boys. The EIN also goes by a few aliases: federal tax identification number or simply, the business tax ID number. It’s essential for stuff like opening a bank account, getting licenses, and navigating the maze of taxes.

Here’s a simple breakdown for you:

| Term | What It Is |

|---|---|

| EIN | Your business’s VIP number from the IRS |

| Other Names | Federal tax ID or business tax ID |

| Why You Need It | For doing taxes and keeping the law happy |

Importance of Having an EIN

Why bother with an EIN, you ask? Here’s the scoop. It’s like your business’s legal name tag, crucial for taxation and staying on the right side of the law. Without it, you’re pretty much stuck.

- Open a Business Bank Account: Most banks won’t let you set up a business account without an EIN. Say goodbye to mingled messes of personal and business finances.

- Hire Employees: Want to pay folks for their hard work? You’re gonna need an EIN to sort out all the nitty-gritty tax stuff.

- Get Licenses: Many business licenses demand an EIN when you’re filling out those lovely forms.

- File Your Business Taxes: Uncle Sam is gonna need your EIN for those federal and state tax returns.

In a nutshell, snagging an EIN sets the stage for your business to strut its stuff and ensures you’re playing by the rules when it comes to finances and legalities.

Eligibility for an EIN

Let’s break it down: Knowing whether you need an Employer Identification Number (EIN) is like having clear directions for a road trip—it’s key to keeping things running smoothly in your business. This part is all about who needs an EIN and why it’s a game-changer.

Criteria for Getting an EIN

Ask yourself these questions. A “Yes” means you’ll need to grab that EIN:

| Question | Answer |

|---|---|

| Got employees? | Yes |

| Does your business operate as a corporation or partnership? | Yes |

| Filing any taxes like Employment, Excise, or Alcohol, Tobacco, and Firearms? | Yes |

| Withholding taxes for income other than wages for a non-resident alien? | Yes |

| Rocking a Keogh plan? | Yes |

If you’re still left scratching your head, no sweat! The IRS has a handy guide to help figure it out (IRS). Any business with employees, and non-employers running as a corporation or partnership, must snag one of these numbers (SBA).

Why You Need an EIN

Let’s dive into the why:

- Legal ID: Think of an EIN as your business’s fingerprints. It’s a unique nine-digit number that’s your business’s ID card in Uncle Sam’s eyes, crucial for legal dealings (NerdWallet).

- Stay on the IRS’s Good Side: If you’ve got folks on payroll or need to file any business taxes, having an EIN isn’t a choice—it’s a must. Makes tax time a little less hair-pulling by keeping everything organized (Justworks).

- Banking Like a Boss: Want a business account? Banks usually ask for an EIN. It helps keep your personal cash separate from your business stash.

Bottom line? Snagging an EIN is not just a smart move; it’s essential for making sure your small business stays in line and runs like a well-oiled machine.

Benefits of Having an EIN

Getting an Employer Identification Number (EIN) can be a game-changer for your small business. Let’s check out the perks you’ll snag when you nab that EIN.

Business Credit Establishment

Think of an EIN as your business’s ticket to fame in the credit world. This little number lets you build and track a credit history unique to your business, making it easier to score loans or get a line of credit later on. Your business’s credit score isn’t just a number; it’s based on how you handle payments and overall cash smarts.

| Benefit | What’s in it for you |

|---|---|

| Establish Business Credit | It carves a separate credit profile for your business from day one. |

| Open Business Bank Accounts | Banks love EINs—they make opening an account a breeze. |

| Form an LLC | Dreaming of an LLC? You’ll need that EIN to make it happen. |

| Hire Employees | Planning on growing your team? An EIN gets the tax stuff sorted. |

| Set Up Pension Plans | Get serious about retirement with an EIN—it unlocks pension plan options. |

Need extra info? Swing by Bill.com and NerdWallet.

Legal Identification and Compliance

An EIN is a unique nine-digit number given to your business by the IRS. This number plays a superstar role in legal and financial dealings.

| Legal Angle | Why it matters |

|---|---|

| Business Identifier | This number is your business’s stamp of identity for the tax folks. |

| Tax Filing Requirement | If you have employees or file business taxes, the IRS wants you to have one of these. |

Score an EIN, and you’re not just checking a box for legal rules; you’re making your business official to banks and tax peeps. For a deeper dive, check out Bill.com and Justworks.

Applying for an EIN

Getting your Employer Identification Number (EIN) is a big deal for small biz folks like you. It’s like getting a business badge you can’t do without. Doing it online is a breeze, and here’s how you can snag it.

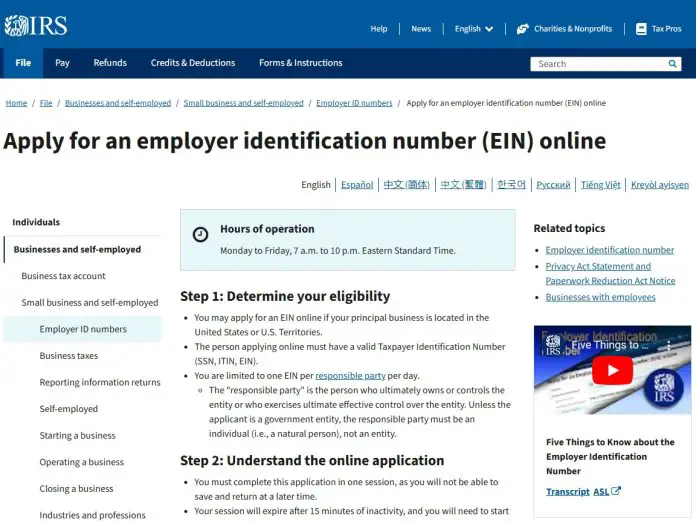

Online Application Process

If you’re looking for speed, the IRS’s online option is your best buddy. Not only is it the fastest, but it gets you that precious EIN right away. No waiting, just a few clicks and you’re done. Head over to the IRS site and follow these easy steps:

- Pop by the IRS EIN application page.

- Fill in the blanks with your deets and the Taxpayer Identification Number (like your SSN, ITIN, or another EIN) for the person in charge.

- Hit submit, and bam, you’re done.

It’s all free, so don’t let those sketchy sites fool you into coughing up cash. (IRS).

Processing Times and Methods

Sure, online’s the turbo mode for a reason, but there are other ways if you’re a little old school. Mailing it in or faxing can take longer, though. Mail drags its feet at up to four weeks before you get that EIN (IRS).

Here’s a quick rundown of how long it’ll take:

| Application Method | Processing Time |

|---|---|

| Online | Instant |

| Up to 4 weeks | |

| Fax | Bit quicker than mail, slower than online |

Some IRS rules since May 21, 2012, say you can’t grab more than one EIN per person each day (IRS). Keeps folks from scooping up numbers like they’re candy.

Stick to these steps, and you’ll have your EIN handy in no time, a must-have as you grow your business.

Getting Your EIN: The Lowdown

Snagging an Employer Identification Number (EIN) is a must-do if you’re running a business, have workers, or gotta file those tax returns. Let’s get the skinny on snagging one and why it’s a big deal.

Quick and Easy EIN

When you go the online route to get an EIN, it pops up instantly as soon as you’re done. This is the way to roll since it’s fast and painless. Here’s your cheat sheet on how to apply:

| How to Apply | How Long It Takes |

|---|---|

| Online | Right away |

| Fax (Form SS-4) | About a week |

| Mail (Form SS-4) | Around 4 weeks |

| If you’re not in the US | Give a ring at 267-941-1099 |

Using the IRS online service to get an EIN is on the house, so watch out for other sites trying to hit you with fees (IRS).

The Hassle Without an EIN

Flying without an EIN can throw some serious curveballs at your biz. Here’s a peek at the headaches you might run into:

| Issue | What It Means |

|---|---|

| Hiring Headaches | No EIN? You’re stuck when it comes to legally sorting out employee wages and taxes. |

| Tax Return Drama | Many businesses gotta file taxes with an EIN, or face the wrath of penalties. |

| Bank Blockades | Banks often need an EIN for business accounts, limiting your cash flow options. |

| Personal Risk Alert | Being a sole proprietor without an EIN puts your personal stuff at risk if things go south. |

Grabbing an EIN is a no-brainer for keeping your business legit and avoiding unnecessary stress. Get it done, so you can keep your eye on the prize and grow your biz like a boss.

Differences Between EIN, ITIN, and SSN

Getting the low-down on EIN, ITIN, and SSN can save any business owner a whole lotta headaches. Each plays its own part in the tax game and business hustle.

EIN vs. ITIN

| Feature | EIN (Employer Identification Number) | ITIN (Individual Taxpayer Identification Number) |

|---|---|---|

| Purpose | IDs your business | Taxes for folks who can’t work in the U.S. |

| Who Needs It | Biz with employees, partnerships, or corporations | Anyone filing taxes without a work permit |

| Use Case | Biz tax matters | Personal taxes without an SSN |

| Eligibility | Any business or solo enterprises | Non-U.S. individuals without SSNs |

So, what’s the deal? An EIN is all about repping a biz, while an ITIN’s the go-to for those who gotta do taxes but can’t clock the hours in the US. Get it?

Protection and Usage of EIN

Your EIN ain’t just a number—it’s legit crucial. It’s like your biz social (keep it tight) ’cause it can get jacked like any ID (NerdWallet).

Your EIN’s got jobs to do, like:

- Getting a biz bank account

- Sorting taxes

- Bringing folks on board

Got a head-scratcher about EINs and your biz setup? The IRS has your back. Keep that EIN close to your chest, and run your biz like the boss you are.

EIN Application Tips

Watch Out for Scammers

Ready to snag your Employer Identification Number (EIN)? Hold up! Beware of those sketchy sites promising help for a fee. Getting an EIN is totally free, courtesy of the Internal Revenue Service (IRS). Loads of scammy folks want you to cough up cash for something that’s free. Make sure you’re chilling on the right website – the official IRS one – when you kick off your application. You can apply directly at the IRS website.

Info You Need for Your Application

Before diving headfirst into the application, gather your stuff. You’ll need to have the following deets at your fingertips:

| What You Need | Details |

|---|---|

| Name of the Entity | That means your business’s legit name. |

| Taxpayer ID Number | You’ll need the SSN, ITIN, or EIN for the one calling the shots. Check IRS for details. |

| Info on the Big Cheese | This is the top dog or whomever wears the boss pants – include their name and Tax ID number. |

| Type of Entity | Are you rolling as a sole prop, corporation, partnership, or something else? Let ’em know. |

Remember: Since May 21, 2012, the IRS plays hardball – one EIN per responsible party a day, no matter how you apply. Don’t stress, though; just have your info ready to roll for a hitch-free application sesh.

EIN Renewal and Handling

EIN Expiration

You might be wondering about how long your EIN sticks around. The good news? Unlike those pesky Individual Taxpayer Identification Numbers (ITINs) that vanish after five years of neglect, your EIN stands the test of time. No expiration dates here! If your business is humming along, your EIN is good to go (Justworks). But change is the spice of life—and business. If you switch gears, say from a cozy sole proprietorship to a bustling corporation, a fresh EIN might be in order. Here’s a handy cheat sheet on when to get a new EIN:

| Change in Business Structure | Need for New EIN? |

|---|---|

| Sole proprietorship to LLC | You betcha! |

| LLC to corporation | Yep! |

| Ownership shake-up (partnership) | Indeed! |

| Business as usual | Nah, you’re good! |

Responsible Party Identification

So, you’re ready to snag an EIN. Who’s the head honcho? The IRS wants to know who’s holding the reins. This top dog—the “responsible party”—is the boss who calls the shots over your business. They’ll need their name and Taxpayer ID (that’d be an SSN, ITIN, or even another EIN) on that application, whether you’re going the paper route or zooming through it online (IRS).

This ain’t just a formality. Picking the right leader—be it a main officer, a partner in crime, an owner, or someone running a trust—is key. This info helps the IRS keep a tidy record and stay in the loop. Mess this up, and you could find yourself tangled in EIN troubles, which is the last thing you need messing with your company mojo.