Key Takeaways

- Protection for Employees and Business: Workers’ compensation insurance provides essential financial support for medical expenses and lost wages, ensuring both employee and employer protection in case of workplace injuries.

- Legal Compliance: Most states mandate that small businesses carry workers’ compensation insurance, helping you avoid legal penalties and ensuring a compliant business environment.

- Enhanced Employee Trust and Morale: Offering this insurance fosters trust among employees, enabling them to focus on their work without fear of financial repercussions from work-related injuries.

- Reduced Liability Risks: Workers’ compensation serves as the exclusive remedy for workplace injuries, limiting employers’ liability and protecting against potential lawsuits.

- Cost Management Strategies: Small businesses should compare insurance providers, implement safety programs, and establish efficient claims processes to manage and potentially lower workers’ compensation costs.

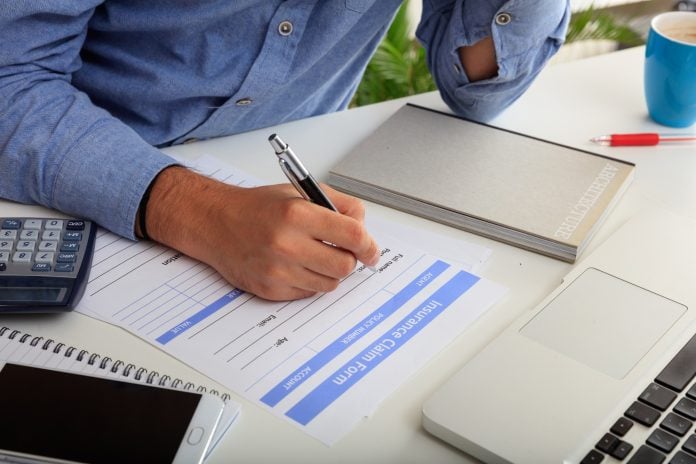

As a small business owner, you wear many hats and juggle countless responsibilities. One crucial aspect you can’t overlook is protecting your employees and your business from unexpected accidents. Workers’ compensation insurance is designed to do just that, providing financial support for medical expenses and lost wages when injuries occur on the job.

Understanding the ins and outs of workers’ compensation can be daunting, but it’s essential for safeguarding your business’s future. Not only does it help you comply with legal requirements, but it also fosters a safer work environment, boosting employee morale and productivity. Let’s dive into why this insurance is a must-have for small businesses and how it can benefit you and your team.

Understanding Workers Compensation Insurance

Workers compensation insurance provides essential protection for your small business and employees. This insurance ensures financial support in the event of workplace injuries, addressing both medical expenses and lost wages.

Definition and Purpose

Workers compensation insurance is a form of insurance that covers medical expenses, rehabilitation costs, and lost wages for employees injured on the job. It aims to protect both employees and employers by offering a safety net in case of accidents. For small businesses, this coverage is vital for compliance with state laws and regulations. By obtaining this insurance, you create a more secure work environment and demonstrate a commitment to employee safety.

Key Benefits for Small Businesses

- Financial Protection: Workers compensation insurance shields your small business from significant financial burdens due to workplace injuries. Without this coverage, injury-related costs can escalate quickly.

- Legal Compliance: Most states require small businesses to carry workers compensation insurance. Maintaining this coverage helps you comply with the law and avoid potential fines.

- Employee Trust: Offering workers compensation insurance fosters trust among your employees. When they know they’re protected, they can focus on their work and perform better.

- Reduced Liability: This insurance can protect you from lawsuits resulting from workplace injuries. If an employee files a claim, workers compensation typically serves as the exclusive remedy, limiting your liability.

- Improved Workplace Safety: Understanding workers compensation can lead to better safety practices. By prioritizing employee health, you can potentially lower your insurance premiums over time.

Incorporating workers compensation insurance into your small business strategy ensures you provide a safe and compliant work environment.

Legal Requirements for Small Businesses

Workers’ compensation insurance is essential for small businesses, as it provides financial protection for both you and your employees in case of workplace injuries or illnesses. Understanding the legal requirements helps you stay compliant and secure a safer work environment.

State-Specific Regulations

Workers’ compensation regulations vary by state, so it’s crucial to familiarize yourself with your state’s specific laws. In most states, any business with one or more employees, including part-time workers, must provide workers’ compensation coverage. For example, in Maine, all businesses with employees must carry this insurance, while sole proprietors, partners, and LLC members are typically excluded but can opt-in for coverage. Knowing these rules allows you to comply effectively while protecting your small business.

Common Exemptions

Certain exemptions exist under workers’ compensation laws that might apply to your small business. For instance, some states exclude specific types of workers, such as independent contractors and certain agricultural employees, from mandatory coverage. Additionally, in many places, sole proprietors might not be required to secure workers’ compensation insurance unless they choose to cover themselves. Understanding these exemptions allows you to assess your coverage needs accurately and make informed decisions regarding your business’s insurance strategy.

Choosing the Right Workers Compensation Policy

Selecting the right workers’ compensation policy is essential for your small business. It protects your employees while shielding your business from financial risks associated with work-related injuries.

Factors to Consider

Understanding key factors when choosing a policy is crucial.

- Coverage Scope: Ensure the policy covers medical expenses, rehabilitation costs, disability benefits, and death benefits. Verify that it aligns with your workforce’s specific risks and needs.

- State Regulations: Know your state’s laws regarding workers’ compensation. Most states require coverage once you employ one or more workers. Requirements can differ significantly, so review them to ensure compliance.

- Exemptions: Identify any exemptions that may apply to your business. Certain independent contractors or agricultural employees might not require coverage, influencing your decision-making.

- Claims Process: Assess the insurer’s claims process. A streamlined, efficient process enhances employee satisfaction and reduces downtime after an injury occurs.

Comparing Insurance Providers

Comparing multiple insurance providers helps you find the most suitable policy.

- Reputation: Research each provider’s reputation in the market. Look for reviews and ratings from other small business owners to gauge reliability.

- Costs: Obtain quotes from various insurers. While costs can vary, ensure that you’re not sacrificing essential coverage for lower premiums.

- Customer Service: Evaluate the customer service offered by potential insurers. Responsive, helpful service can ease the claims process and enhance your overall experience as a small business owner.

- Customization Options: Consider providers that offer customizable policies. Tailoring coverage to your specific business needs creates a safety net for your employees and helps you maintain compliance with state laws.

By carefully evaluating these factors and comparing providers, you can choose a workers’ compensation policy that provides essential protection for your small business and your employees.

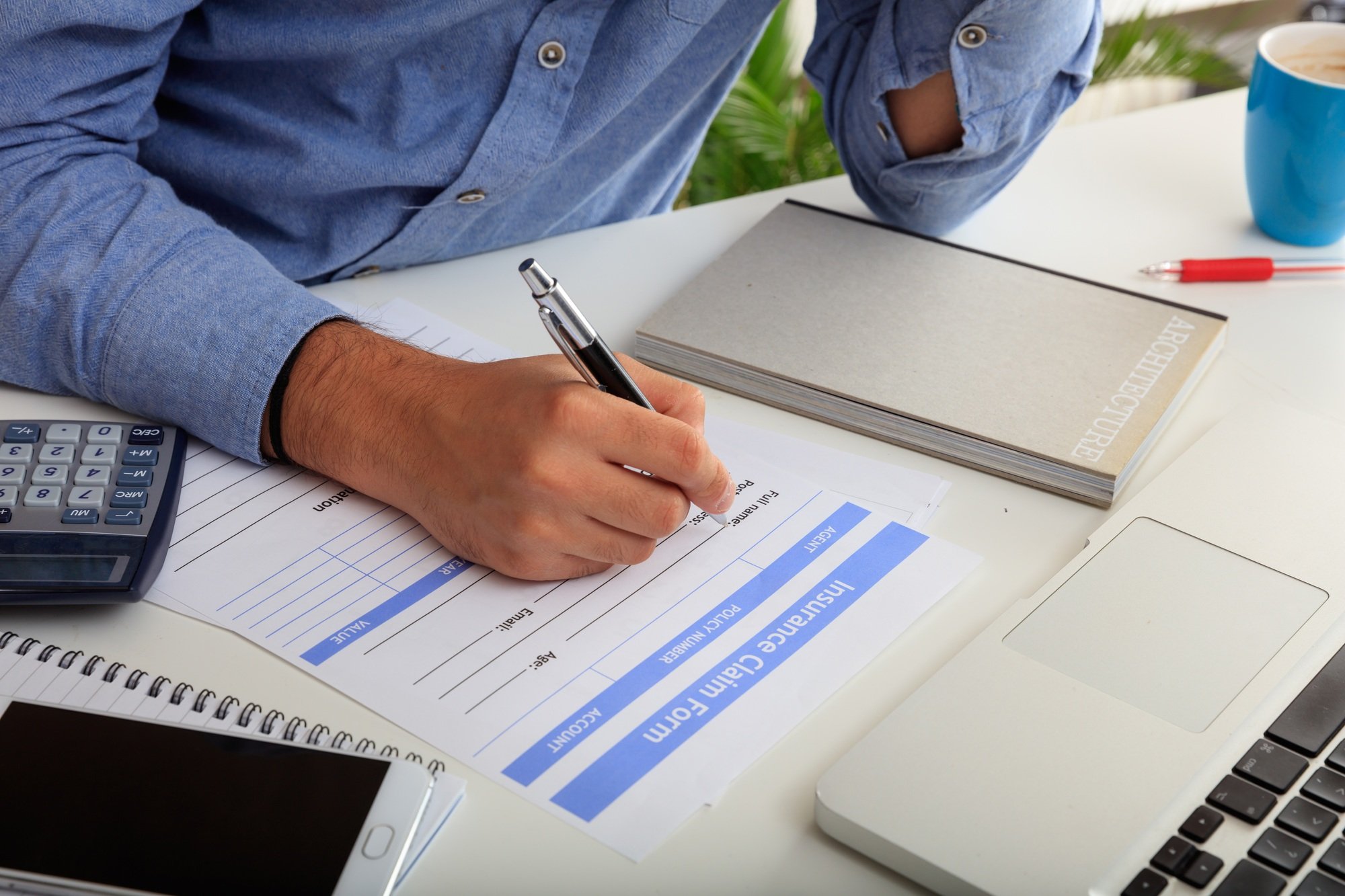

Claims Process for Workers Compensation

Understanding the claims process for workers’ compensation is crucial for small businesses. It ensures you can manage work-related injuries effectively and comply with legal requirements.

Reporting a Work-related Injury

When an employee suffers a work-related injury or illness, take immediate action. Prioritize these steps:

- Immediate Medical Attention: Ensure the injured employee gets medical treatment right away. If the injury is severe, call 911 or take them to a medical facility. Inform the healthcare provider that the injury is work-related. This information assists in proper documentation and treatment.

- Notify the Employer: The injured employee should notify you as soon as possible. Timely notification aids in expediting the claims process and ensures you can start addressing the situation immediately.

Steps to File a Claim

Filing a workers’ compensation claim involves several key actions. Follow these steps to streamline the process:

- Document the Incident: Collect all relevant details about the injury. Include the date, time, location, and circumstances surrounding the incident. Accurate documentation supports the claim and protects your small business.

- Complete Required Forms: Fill out the necessary claim forms provided by your workers’ compensation insurer. Ensure all information is accurate and thoroughly detailed to avoid delays.

- Submit the Claim: Send the completed claim forms to the insurance provider within the required timeframe set by your state. Timely submission is vital for claim approval.

- Track the Progress: After your submission, follow up with the insurer to track the claim’s status. Consistent communication promotes a smoother claims process and provides updates on the employee’s recovery.

- Stay Informed: Keep yourself and your employees updated on the claims process. Sharing information about the status of claims can enhance trust and morale within your small business.

By adhering to these steps, you can effectively manage the claims process for workers’ compensation, ensuring that your employees receive the benefits they need while safeguarding your small business interests.

Cost Considerations

Understanding the costs associated with workers’ compensation insurance is crucial when running a small business. These costs can significantly impact your overall budget and financial planning.

Average Premiums for Small Businesses

The cost of workers’ compensation insurance for small businesses varies widely, generally ranging from a few hundred to several thousand dollars annually. For example, if your business has a total payroll of around $100,000, you might pay between $700 and $3,000 in insurance costs each year. Premiums depend on several factors, such as industry classification, payroll amount, location, and claims history. As an example, a business with a yearly payroll of $85,000 and a workers’ comp rate of $1.50 would incur estimated annual premiums of $1,275.

Tips for Managing Costs

Managing workers’ compensation insurance costs requires strategic planning. Consider the following tips:

- Shop Around: Compare rates from different providers. Get quotes from multiple insurers to find the best rate.

- Review Coverage: Assess your policy periodically. Ensure you carry the necessary coverage without overpaying for unnecessary extras.

- Implement Safety Programs: Focus on mitigating workplace risks. Enhanced safety measures can lead to fewer claims and lower premiums.

- Establish Claims Management Procedures: Efficiently handle claims to prevent escalating costs. Timely reporting and processing of claims can limit financial impact.

- Educate Employees: Promote workplace safety awareness. Training employees on safe practices reduces the likelihood of work-related injuries.

By considering these strategies, you can manage costs effectively while ensuring your small business remains compliant and protected.

Conclusion

Investing in workers’ compensation insurance is essential for safeguarding your small business and its employees. With the right coverage, you can protect against unexpected financial burdens from workplace injuries while ensuring compliance with legal requirements.

By understanding your state’s regulations and selecting a policy that fits your specific needs, you create a safer work environment that fosters trust and productivity.

Prioritizing workplace safety and efficient claims management not only benefits your employees but also strengthens your business’s financial stability. Take the necessary steps today to secure the protection your business deserves.

Frequently Asked Questions

What is workers’ compensation insurance?

Workers’ compensation insurance provides financial support for medical expenses and lost wages resulting from workplace injuries. It’s essential for protecting both employees and employers against unforeseen accidents and ensuring a compliant work environment.

Why is workers’ compensation important for small businesses?

Workers’ compensation is crucial for small businesses as it protects them from injury-related costs, ensures compliance with legal requirements, and fosters employee trust, which can lead to improved morale and productivity.

Are all businesses required to have workers’ compensation insurance?

Most states require businesses with one or more employees to have workers’ compensation insurance. However, specific exemptions, such as independent contractors and certain agricultural workers, may apply depending on local regulations.

How do I choose the right workers’ compensation policy?

Consider factors such as the scope of coverage, state regulations, and exemptions when choosing a policy. Additionally, compare multiple providers based on reputation, cost, and customer service to find the best fit for your business.

What is the claims process for workers’ compensation?

When an employee is injured, ensure they receive medical attention, notify the employer promptly, and document the incident. Follow up with necessary forms and submit the claim within your state’s deadline to ensure timely processing.

How much does workers’ compensation insurance cost?

Costs for workers’ compensation insurance can vary widely, ranging from a few hundred to several thousand dollars annually. Factors like industry classification, payroll amount, and claims history influence the premiums you’ll pay.

How can small businesses manage workers’ compensation costs?

Small businesses can effectively manage costs by shopping around for quotes, reviewing coverage regularly, implementing safety programs, and educating employees on workplace safety to reduce claims and improve compliance.

Image Via Envato