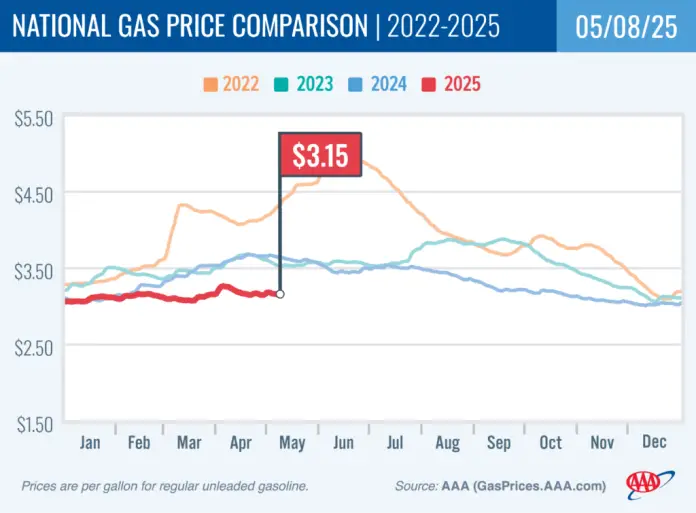

As we transition into the summer travel season, small business owners can breathe a sigh of relief amid a recent dip in gas prices, which has seen the national average fall to $3.15 per gallon. This decrease offers a welcome break for businesses that rely on transportation for logistics or customer engagement, as the cost of fuel directly impacts operating expenses.

According to the latest data from the American Automobile Association (AAA), gas prices have dropped three cents from the previous week and are nearly 49 cents lower than they were one year ago. This trend is driven by a fall in gas demand, which recently decreased from 9.09 million barrels daily to 8.71 million, compounded by OPEC+’s decision to increase oil output beginning June.

With many small businesses relying on road travel for deliveries, client visits, or employee commuting, the potential for reduced fuel costs is significant. Lower gas prices can free up cash flow that small businesses can redirect toward other operational needs or investment opportunities.

The most recent statistics illustrate a broader picture of a shrinking gas demand. Domestic gasoline supply has also seen a slight increase, moving from 225.5 million barrels to 225.7 million. Although gasoline production has decreased, averaging 9.7 million barrels per day, the surplus supply might continue to exert downward pressure on prices.

“Consumers will likely see lower prices at the pump this summer," said an AAA spokesperson. "For businesses that operate fleets or depend heavily on travel, these savings can have a meaningful impact on their bottom line.”

For those in the delivery sector or companies that require extensive travel for sales or services, the reduced fuel costs may come as a welcome change. As road trip season approaches, businesses that encourage travel for both employees and customers could capitalize on this trend, enticing clients with travel incentives or promotions.

However, fluctuations in fuel prices are not without their challenges. While a decrease in gas costs presents clear benefits, small business owners should remain vigilant about potential volatility in the oil markets. The closure of trading sessions recently showed West Texas Intermediate (WTI) oil settling at $58.07 a barrel, which signifies that even smaller shifts can severely affect fuel pricing.

Additionally, electric vehicle (EV) adoption is slowly gaining traction, and charging infrastructure remains a concern. The national average cost for electricity at public EV charging stations increased two cents from last week to 36 cents per kilowatt-hour. As businesses weigh the costs of maintaining traditional vehicles versus transitioning to electric fleets, these dynamics will be essential for budgeting future transportation costs.

State-specific variations also play a significant role in understanding costs and opportunities. States like Mississippi ($2.64) and Louisiana ($2.70) showcase the least expensive gas markets, while Californians face considerably higher costs at the pump, with averages reaching as high as $4.82. Such disparities may inform strategic decisions regarding branch locations, employee remote work policies, or delivery routes and methods.

Moreover, considering costs associated with electric vehicle charging can be just as important. For instance, states like Kansas (22 cents per kWh) offer a stark contrast to Hawaii (54 cents per kWh), establishing a clear map of ideal locations for businesses looking to support a more sustainable fleet.

As summer travel approaches, small businesses are poised to benefit from more favorable gas prices and should consider these trends when planning logistics and operational strategies. Maintaining awareness of ongoing shifts in both the gasoline and electric markets will be crucial for ensuring sustainable budgeting and maximizing the potential of their travel-related operations.

For additional insights and the latest updates on gas and electric vehicle charging prices, interested parties can visit the AAA’s official page here.

Image Via Gas Price