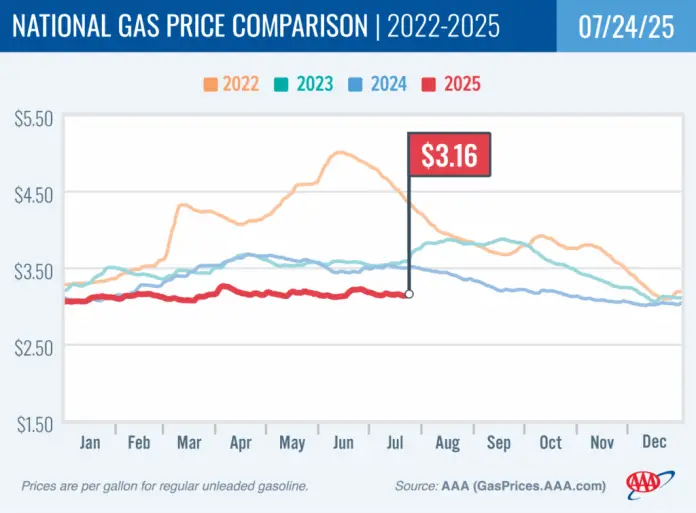

As summer deepens, small business owners are facing an important update: gas prices are holding steady at around $3.16 per gallon, following a slight decrease observed over the past week. This change comes as crude oil prices average $65 per barrel, maintaining a relative calm in what is often a volatile market. For small businesses reliant on transportation—be it for deliveries, commuting, or service access—these trends carry significant implications.

Data from the Energy Information Administration (EIA) shows a noticeable uptick in gasoline demand last week, rising to 8.96 million barrels per day from 8.48 million. Meanwhile, domestic gasoline supply has slightly declined, dropping from 232.9 million barrels to 231.1 million. Gasoline production has steadied at an average of 9.4 million barrels daily. This equilibrium can be advantageous for small businesses as it points towards predictability in fuel costs.

Quotes from industry representatives underscore the importance of monitoring these trends. “Steady gas prices mean less volatility for small business owners who depend on transportation,” noted an analyst. This predictability may allow businesses to plan expenses more accurately, enabling better budget management—especially critical for those who operate fleets or have employees traveling for work.

Yet alongside these benefits, fluctuations in gas prices in different states present challenges. For example, states like California and Hawaii are grappling with some of the nation’s highest fuel costs, reaching $4.48 and $4.46, respectively. Business owners in these areas may struggle with increased operational costs, potentially leading to price hikes in their services or products.

Contrastingly, states such as Mississippi and Louisiana feature lower gas prices, at about $2.70 and $2.77 per gallon. Small businesses operating in these regions may experience a financial reprieve and could leverage their lower operational costs to outcompete businesses in higher-priced markets.

The EIA also reported that U.S. crude oil inventories are approximately 9% below the five-year average for this time of year, which might indicate tighter supply constraints in the future. As small business owners plan for the coming months, they should consider how these factors may affect their logistical operations and fuel budgeting.

Electric vehicle (EV) adoption is another consideration. The average cost per kilowatt-hour at public charging stations remains stable at 36 cents. While the initial investment in EVs may be significant, the lower fuel costs associated with electric driving can lead to long-term savings. Small businesses with fleets may want to explore EV options, especially in regions where gas prices remain high. Transitioning to electric vehicles could provide a buffer against rising fuel costs in the future while also aligning with sustainability initiatives.

In terms of charging infrastructure, the highest prices for electricity at public charging stations are found in states like West Virginia and Alaska, reaching 52 cents per kilowatt-hour. Conversely, Kansas leads with the lowest charging costs at 25 cents. Small business owners in states with lower charging rates may find it beneficial to transition sooner to electric vehicle fleets, capitalizing on these lower operational costs while also contributing to a greener economy.

To navigate these evolving fuel and energy landscapes, small business owners are encouraged to stay informed. Utilizing tools like the AAA TripTik Travel Planner can help monitor gas and EV charging prices while planning efficient routes. By doing so, businesses can mitigate the impact of fluctuating fuel costs, ultimately improving their bottom lines.

For more information on current gas prices and trends, visit the AAA website at AAA Gas Prices.

Image Via Gas Price