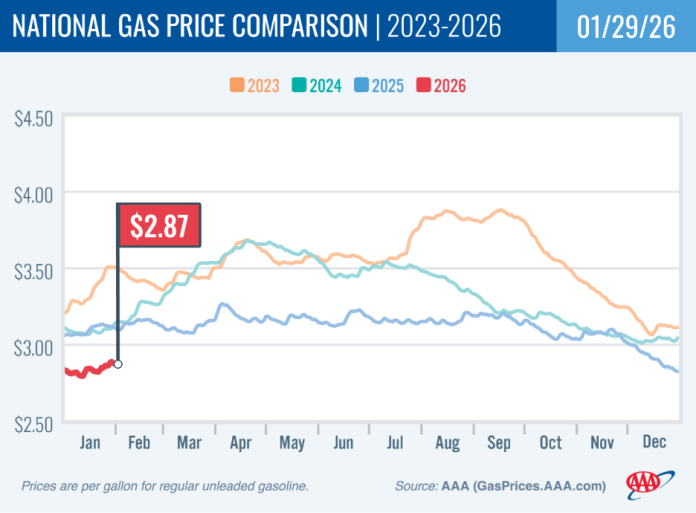

In the wake of a powerful winter storm that wreaked havoc across the United States, gas prices have experienced a notable uptick, now averaging $2.87 per gallon for regular gasoline. Despite this increase, prices remain lower than they were a year ago, when the national average stood at $3.12, according to the latest report from the American Automobile Association (AAA).

As small business owners brace for the financial implications of changing fuel costs, it’s essential to understand the underlying factors contributing to these shifts. Following the winter storm, below-freezing temperatures and residual snow disrupted crude oil production and refinery operations. In anticipation of severe weather, gasoline demand surged as drivers rushed to fill their tanks, contributing to the price hike observed last week.

Gas prices climbed from $2.85 a week ago, with the Energy Information Administration (EIA) reporting a significant increase in gasoline demand, which rose from 7.83 million barrels per day (b/d) to 8.75 million. Meanwhile, total domestic gasoline supply slightly increased, sitting at 257.2 million barrels, a marginal adjustment in response to the heightened demand.

Current data shows gasoline production averaging 9.6 million b/d, indicating that while the industry is responding to increased demand, challenges remain on the crude supply side. At the close of trading last Wednesday, West Texas Intermediate (WTI) crude prices settled at $63.21 per barrel, reflecting an 82-cent increase, driven in part by a reported decline in crude oil inventories. With current inventory levels about 3% below the five-year average, the potential for future price fluctuations is significant.

This situation presents several implications for small business owners, particularly those reliant on transportation and logistics. Higher fuel costs can directly impact operational expenses, making it vital for businesses to revisit budgeting and financial strategies. Some owners may need to consider adjusting delivery fees, updating pricing structures, or exploring cost-effective alternatives like fuel-efficient vehicles or routes.

Additionally, the rising interest in electric vehicles (EVs) offers a glimpse into a potential long-term solution for businesses looking to mitigate fuel-related costs. The average price per kilowatt-hour at public EV charging stations stands at 38 cents. Although EV adoption is growing, business owners must weigh the current expensive charging rates—some states charge as much as 51 cents per kWh—against the benefits of transitioning to electric fleets.

Regional variations in gas prices can further complicate budgeting for businesses operating across state lines. For example, Hawaii leads the nation with prices averaging $4.41 per gallon, while Oklahoma boasts the lowest at $2.40. Such disparities require careful planning and monitoring of fuel expenses to ensure profitability.

Furthermore, state-by-state differences extend to EV charging costs. For instance, West Virginia sees charging rates as high as 51 cents, contrasting starkly with Kansas, where it is only 25 cents. Business owners should evaluate these variances when considering investments in electric fleets and installations, as they will play a key role in overall cost management.

For those looking to navigate these turbulent waters, the AAA TripTik Travel planner provides a valuable tool for tracking current gas and electric charging prices along routes. This can aid in forecasting fuel costs and refining travel plans.

While the recent increase in gasoline prices signals challenges ahead, they also present an opportunity for small business owners to reassess their strategies and consider innovative solutions. Fully understanding the dynamics at play will be crucial as they adapt to the evolving landscape of fuel prices and explore sustainable options moving forward.

For more information, visit the full report from AAA here.

Image Via Gas Price