The latest forecasts from the U.S. Energy Information Administration (EIA) indicate that the global consumption of crude oil and other liquid fuels is set to decelerate over the next two years. This slowdown could pose both opportunities and challenges for small business owners who rely on the fluctuations in energy markets and economic conditions.

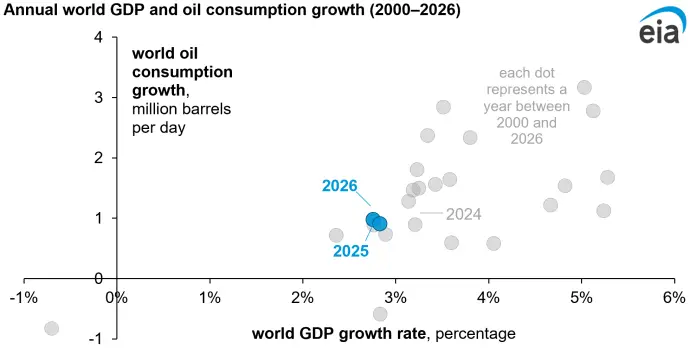

According to the EIA’s May 2025 Short-Term Energy Outlook, global economic growth is projected to rise by only 2.8% in both 2025 and 2026, marking the lowest growth rates since 2008, excluding the outlier years of the COVID-19 pandemic. These economic indicators have a direct impact on oil demand. As Jeff Barron, the principal contributor to the report, stated, “Economic activity uses energy,” meaning any slowdown can directly influence oil consumption patterns.

Oil consumption globally was estimated at approximately 103 million barrels per day (b/d) last year. However, the EIA forecasts that growth will shrink to less than 1 million b/d over the next two years, a stark contrast to the average growth of 1.3 million b/d observed in the two decades preceding the pandemic. Small business owners should note that, historically, annual oil consumption growth has dipped during times of economic growth below 3%.

The key takeaway from the EIA’s analysis is that much of this downward trend in oil consumption growth is concentrated in Asia, with projections indicating a reduction from 0.7 million b/d to 0.5 million b/d. In contrast, moderate changes are anticipated in the Americas, Europe, the Middle East, and Africa.

Several factors contribute to this slowdown. Recently enacted tariffs on U.S. trading partners may already be hindering global trade in physical goods, as evidenced by preliminary shipping data. Reduced global trade leads to fewer shipments and deliveries, which could have downstream effects on employment and leisure travel—both significant contributors to oil demand.

For small business owners, the implications of these forecasts are worth considering. A slowdown in oil consumption may lead to lower fuel prices, which can provide cost relief for businesses that rely heavily on transportation. However, these benefits could be offset by decreased consumer spending driven by sluggish economic growth.

Challenges are also on the horizon, particularly in terms of market volatility. The EIA points out that its forecast remains highly uncertain, driven by variables such as vessel traffic, truck tonnage, and airport passenger throughput, all of which serve as real-time indicators of economic activity. Business owners should monitor these indicators closely, as they can serve as early warning signs for changing oil consumption trends.

For those in logistics, transportation, or any sector affected by energy costs, the EIA’s Weekly Petroleum Status Report provides valuable insights into U.S. petroleum consumption, which accounts for about 20% of world consumption. Staying informed can help small businesses make more strategic decisions regarding fuel use and transportation planning.

As the economy continues to navigate this uncertain landscape, small business owners must remain agile, leveraging available resources to adapt to shifting energy demands and economic conditions. By staying informed about industry trends, fluctuations in oil consumption, and economic indicators, they can better position their businesses for success in a changing market landscape.

For more detailed information, you can view the original EIA report here.

Image Via US Energy