Natural gas markets in the United States are witnessing a significant shift towards greater stability, providing a more predictable environment for small business owners who rely on energy for their operations. Recent findings from the Energy Information Administration (EIA) indicate a notable decline in the volatility of natural gas prices, a trend that could have far-reaching implications for budgeting and planning in the small business sector.

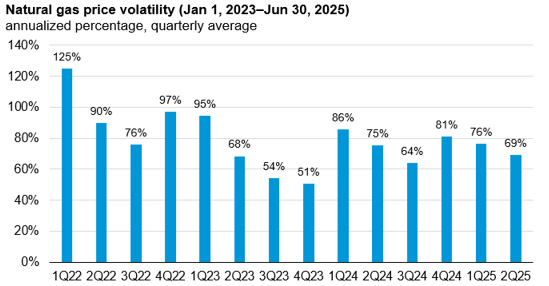

From a high of 81% in late 2024, the average historical volatility of the Henry Hub front-month futures price dropped to 69% by mid-2025. This positive trend signals a return to typical seasonal patterns, attributed to improved storage conditions that align closely with the five-year average. As Andrew Iraola, a principal contributor at the EIA, notes, “The decreased volatility reflects greater market stability, which can facilitate more effective planning for businesses dependent on this crucial energy source.”

For many small business owners, fluctuating energy prices can pose serious challenges. High volatility often leads to uncertainty in operating costs, making it difficult to set budgets. A more stable pricing environment allows for better forecasting and resource allocation, easing the financial burden that energy costs often impose. This is especially important for businesses in energy-intensive industries, such as manufacturing and agriculture, where every percentage of cost control can significantly impact the bottom line.

The recent analysis from the EIA highlights that natural gas inventories, which plummeted during a polar vortex in January 2025, started increasing robustly through the second quarter. Injections into storage exceeded 100 billion cubic feet (Bcf) per week for an impressive seven consecutive weeks, the longest streak since 2014. By the end of the second quarter, natural gas inventories stood 6% above the five-year average, alleviating concerns about supply availability and contributing to a decline in price volatility.

However, it’s crucial for small business owners to remain proactive in monitoring market conditions. While the current trend suggests stability, natural gas prices are subject to fluctuations based on a variety of factors, including seasonal changes and geopolitical events. “We cannot ignore the disruptions that may arise from unpredictable weather patterns or international supply issues,” warns Iraola.

For small business owners, this presents both opportunities and challenges. On the one hand, more predictable pricing can lead to enhanced operational efficiency. Companies can lock in lower, stable rates, potentially through long-term contracts, leading to substantial savings on utility costs. Furthermore, businesses that invest in energy efficiency measures or alternative energy sources may also find themselves at an advantage, especially if competition begins to normalize their energy expenses.

On the flip side, there are challenges that require attention. Companies must be prepared for potential spikes in demand that could arise from unexpected temperature extremes or other disruptive events. Keeping abreast of market trends and having a contingency plan in place will be crucial for small businesses to navigate potential volatility.

Moreover, not all businesses engage equally with the natural gas market. For those that primarily rely on other energy sources, such as electricity or oil, the implications of these fluctuations may be less direct but still warrant attention. Understanding how natural gas prices influence overall energy costs can help small business owners make informed decisions about their energy strategies.

In summary, the decline in natural gas price volatility presents a welcoming sign for small businesses looking to stabilize their energy costs. Improved storage conditions and stable market dynamics suggest a more predictable environment, allowing businesses to plan more effectively for the future. However, owners must also remain vigilant to safeguard against potential disruptions that could impact energy availability and pricing.

For detailed insights and data on this topic, refer to the EIA’s original report here.

Image Via US Energy