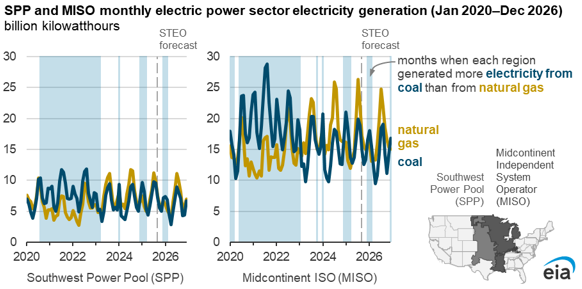

Midwestern electricity markets are poised for a significant shift this winter, as two major regions, the Southwest Power Pool (SPP) and the Midcontinent Independent System Operator (MISO), are forecasted to generate more electricity from coal than from natural gas. According to the latest Short-Term Energy Outlook from the U.S. Energy Information Administration (EIA), coal generation in these areas is expected to exceed natural gas production from December 2025 through February 2026.

This trend marks a notable change compared to previous years. As recently as 2021 and 2022, both SPP and MISO consistently produced more electricity from coal throughout the year. However, in recent months, coal has mostly outpaced natural gas only during the winter months, driven by increased demand for space heating.

For small business owners in the Midwest, especially those in sectors reliant on energy-intensive operations, understanding these fluctuations in energy generation could have meaningful implications. While natural gas has overtaken coal as the dominant source of electricity in most regions of the U.S. since early 2018, both SPP and MISO remain exceptions. It’s critical for business owners to stay informed about these trends as they directly impact energy costs.

Key Takeaways:

- Winter Electricity Generation: Forecasts suggest coal will surpass natural gas generation in SPP and MISO from December 2025 to February 2026.

- Historical Context: Coal was the dominant electricity source in these regions until recent years; natural gas has gained ground, but seasonal demands may reverse this trend temporarily.

- Regional Nuances: In most other U.S. electricity markets, natural gas has consistently outperformed coal since 2010, reflecting a clear regional distinction in energy sourcing.

Jonathan Church, a principal contributor at the EIA, emphasizes that "coal remains competitive, especially when natural gas prices are relatively high.” He suggests that winter months can create supply challenges for natural gas, such as production freeze-offs, which may hinder the dispatch of natural gas-fired power plants. This could mean higher electricity costs for businesses relying on natural gas at peak times.

Implications for Small Businesses:

Small business owners in the Midwest should take note of potential energy price volatility this winter, which could result from the interplay between coal and natural gas generation. Companies that rely heavily on electricity for operations should consider energy management strategies that account for these seasonal shifts.

This is particularly pertinent for businesses that operate during peak demand hours in winter, as energy supply constraints could lead to increased costs. Therefore, now may be an opportune time to reassess energy contracts or even explore alternative sources of energy if feasible.

Furthermore, as older coal-fired power plants continue to retire—most of which began operation before 1990—there may be a gradual shift back towards natural gas or renewable energy sources in the long run. Many newer natural gas generators, particularly more efficient combined-cycle units built after 2000, are becoming the norm in these regions.

Nevertheless, challenges remain. While some businesses have benefited from historically lower natural gas prices, any fluctuations due to rising demand in winter could impact operational costs. Additionally, factors such as government policies or incentives promoting renewable sources could further complicate the landscape for small business owners already navigating fluctuating energy costs.

Staying informed about regional electricity trends is crucial for small business operators who not only seek cost-effective solutions but also aim for sustainability. Understanding the dynamics of both coal and natural gas generation in the SPP and MISO will be essential for strategic planning in the coming months.

For more details on this emerging trend in electricity generation, you can read the full analysis from the Energy Information Administration here.

Image Via US Energy