As the back-to-school season kicks off, a fresh academic year offers students a perfect opportunity to refine study habits and tackle previously challenging subjects. This semester, students can harness the power of Gemini 3, Google’s latest AI-driven model, designed to enhance learning experiences from high school through college.

Gemini 3 stands out with its advanced capabilities tailored specifically for students preparing for significant exams like the SAT and JEE, as well as those navigating complex college courses. With technology rapidly reshaping educational landscapes, small business owners in the education sector can leverage these updates to offer enriched services and resources to their clientele.

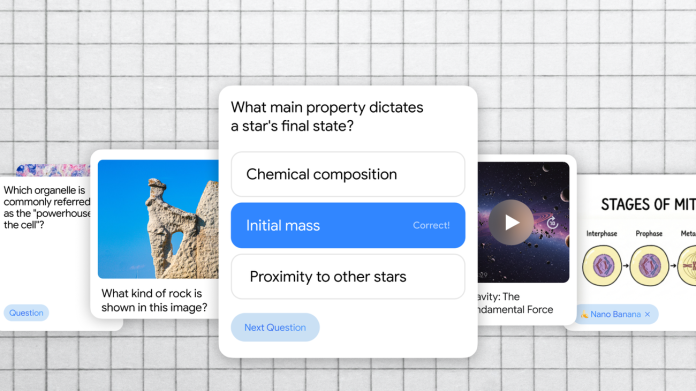

Gemini 3 promises to be a game-changer by providing personalized learning approaches. It utilizes AI to analyze individual study patterns and challenges, offering tailored guidance that fosters deeper understanding. For example, students can receive customized practice questions and instant feedback, allowing them to focus on areas needing improvement and reinforcing successful strategies.

A notable feature of Gemini 3 is its ability to adapt content based on the user’s progress. This dynamic adjustment means that students can engage with materials that are neither overwhelming nor too simplistic, striking the perfect balance for effective learning. Such personalization can enhance motivation and drive better results, qualities that educational institutions and tutoring businesses could capitalize on by integrating Gemini into their curriculums or platforms.

Moreover, the technology encourages collaboration, enabling students to work together more efficiently and share insights on study materials. With group projects frequently constituting a significant part of modern education, small businesses could consider hosting workshops or sessions that utilize Gemini to foster teamwork and cooperation among students.

Despite these advantages, small business owners should remain mindful of potential challenges. Integrating advanced technology like Gemini into existing educational frameworks may require a learning curve for both educators and students. Additionally, small businesses must evaluate the cost implications of deploying such sophisticated tools, ensuring they align with budget constraints while still delivering exceptional value.

Furthermore, while Gemini offers innovative solutions, the reliance on technology raises questions about accessibility. Business owners should proactively address how to make these tools available to all students, regardless of socioeconomic backgrounds. Ensuring equitable access will not only enhance a brand’s reputation but also contribute positively to the learning ecosystem.

Real-world implications also extend to small businesses that provide educational resources or tutoring services. By adopting Gemini 3’s methodologies, they can stay competitive in a rapidly evolving market, differentiating themselves through modernized offerings that appeal to tech-savvy students and parents. Incorporating AI-driven techniques can position these businesses advantageously, aligning their services with contemporary educational needs.

A representative from Google noted, "Gemini is designed to help you learn more deeply, from the classroom to the SAT and beyond. This new model provides tools that adapt to every learner’s journey, making it easier to tackle complex concepts and stay ahead of the curve.” This perspective encapsulates the essence of Gemini’s potential: not just to enhance learning but to prepare students for the challenges of today’s educational demands.

With the continued advancement of AI and technology in education, small business owners have a unique opportunity to embrace innovation, creating offerings that resonate with the needs of today’s learners. As they consider integrating solutions like Gemini 3, it’s crucial to remain attentive to both the opportunities and challenges that accompany new technologies.

To explore more about the features of Gemini and their implications for students, you can read the full announcement from Google here. As educational landscapes continue to evolve, being proactive and adaptable will be key strategies for small businesses aiming to thrive in this exciting phase of learning.

Image Via Gemini