The recent release from the National Taxpayer Advocate reveals a mixed bag for small business owners as they gear up for the 2026 tax season. Erin M. Collins, the National Taxpayer Advocate, highlighted both the achievements of the 2025 filing season and the hurdles that lie ahead in her Fiscal Year 2026 Objectives Report to Congress.

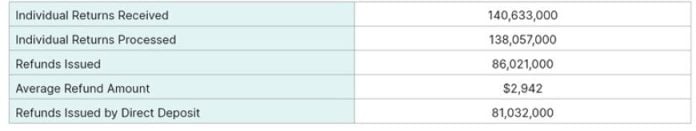

Key benefits emerged from the 2025 season, with the IRS processing approximately 138 million individual tax returns and receiving nearly 95% electronically—indicating a significant shift towards digital submissions. Refunds were issued for about 62% of these returns. Collins stated, “The 2025 filing season was one of the most successful filing seasons in recent memory,” which bodes well for taxpayers and small businesses alike. However, underlying challenges threaten to affect the upcoming filing season, particularly for small business owners who often rely on timely refunds for cash flow.

Despite the smooth processing, there were notable refund delays for identity theft victims—a long-standing issue that could jeopardize small businesses that depend heavily on fast reimbursements. This delay remains a pressing concern, particularly for vulnerable populations who might depend on their tax refunds to meet operational costs. Collins emphasized the urgent need for the IRS to prioritize the resolution of these identity theft cases, which currently take an average of 20 months to resolve. This situation not only affects individuals but can also impact small business owners entangled in identity theft cases, who may face cash flow interruptions and operational challenges.

As the IRS prepares for the 2026 season, staffing constraints amplify the need for early action. The agency’s workforce has diminished significantly—a reduction of 26% since the start of the 2025 filing season—leading to concerns about whether the IRS can adequately handle the demands of the upcoming tax season. Collins warned that the cuts “could jeopardize the success of next year’s filing season.” This is particularly important for small businesses that often rely on clarity and quick responses from the IRS regarding tax matters. The report calls for immediate action to recruit and train new personnel, ensuring taxpayers, including small business owners, receive the services and assistance they need.

The report outlined concrete recommendations aimed at addressing these pressing issues. One priority is modernizing IRS technology. The IRS is urged to develop fully functional online accounts for taxpayers to streamline their interactions, something that could greatly benefit small business owners. Collins pointed out the significant capabilities offered by modern banking systems, which currently are lacking in the IRS’s online infrastructure. Expanding these functionalities would not only improve user experience but also reduce the time small business owners spend navigating tax issues online.

The digitalization of the paper filing process represents another clear opportunity for small businesses. The current manual transcription method for nearly 43 million paper tax returns could be improved with better technology. Collins remarked on this inefficiency, suggesting that true modernization must happen from the moment a document arrives at the IRS through to its final processing. Improved automation can eliminate bottlenecks and speed up the resolution of tax matters, which is critical to maintaining healthy cash flow for small businesses.

However, small business owners should remain vigilant about potential hurdles related to these proposed changes. Implementing significant updates to technology and procedures often comes with complications, especially during transitions. As the IRS works to integrate about 60 disparate case management systems, service disruptions may arise. Such disruptions could lead to further delays in handling inquiries or resolving issues, leaving many small business owners in precarious positions regarding their tax filings and repayments.

Colins also noted the need for the IRS to focus on a few key projects rather than attempting to solve every issue at once. “If everything is a priority, nothing is a priority,” she cautioned. This sentiment emphasizes the importance of strategic investment in tax administration that serves the interests of both the IRS and taxpayers.

As the IRS prepares for 2026, small business owners are encouraged to stay informed of these developments. Early preparation and awareness of potential challenges can help them navigate the upcoming tax landscape more effectively. By putting pressure on tax officials to address these persistent issues, small business owners can advocate for a smoother process and better outcomes.

For more detailed insights, you can read the full report here: National Taxpayer Advocate Issues Mid-Year Report.

Image Via IRS